ACT Expo 2025: The Business Case for Fleet Electrification

In April 2025, 2050 Partners’ Jim Frey and Grant Alpert joined over 12,000 professionals at the Advanced Clean Transportation Expo (ACT Expo) in Anaheim—North America’s largest event focused on advanced technologies for commercial vehicles.

As momentum builds around fleet decarbonization, this year’s event highlighted critical insights and innovations that can help utilities, regulators, and fleet operators shape effective strategies. Below are key takeaways from the conference.

FLEET ELECTRIFICATION IS NO LONGER JUST FOR LIGHT DUTY

While there are many options for electrification of Class 2-6 vehicles, like the Brightdrop or Ford E-Transit vans, ACT Expo focused on the myriad options for Class 7 and Class 8 long-haul trucks. Legacy OEMs like International and Volvo highlighted their Battery Electric Class 8 trucks and new entrants such as Harbinger continued releasing driver-focused vehicles.

Other than the cost gap, one challenge that was consistently highlighted was the lack of consistent charging options. However, panel sessions and booth displays highlighted several innovations that could help close the charging gap. Companies like Amphenol, WattEV, and Delta all highlighted Megawatt Charging Systems (MCS). Although no vehicles on display were equipped with MCS ports, Kempower spotlighted a European pilot planning to deploy them. Additional innovations in battery density, wireless charging, and high-speed charging are helping close the gap for medium and heavy-duty fleet electrification.

OPERATORS ARE EXPLORING MULTIPLE EMISSION REDUCTION PATHS

While recent ACT Expos have felt almost exclusively focused on electrification, several OEMs and fleet managers highlighted options for hydrogen-powered fuel cell vehicles or even renewable natural gas as viable ways to reduce the carbon intensity of fleet operations. Volvo Group’s CTO, Lars Stenqvist, described a three-pronged strategy combining battery electric, hydrogen, and renewable natural gas (RNG), underscoring that gas-powered engines remain in their near-term plans. While they still focused on being a carbon neutral company, part of that came with the caveat that hydrogen and renewable natural gas would play a role in their portfolio. Harbinger Motors unveiled a medium-duty chassis with an onboard gas generator, extending vehicle range and offering a transitional step toward full electrification.

Suppliers also showcased solutions for mobile charging services (“on-demand charging”), highlighting the need for more reliable charging infrastructure before companies are willing to commit to fully electric medium- and heavy-duty fleets. Other solutions, like mobile microgrids powered by renewable natural gas or propane, focused on reducing rolling emissions and pollutants to get solutions to market sooner, rather than waiting on utilities to bring power to the desired locations.

FLEET ELECTRIFICATION IS NOW MORE SELECTIVE

Unlike past conferences that emphasized full-fleet electrification, this year highlighted a more targeted approach. With reductions in incentives and increasing global headwinds, the need for EV purchases to “pencil out” on cost is higher than ever. To address cost parity challenges, speakers focused on situations where EVs can provide the highest benefit, such as trucks that can leverage regenerative braking during heavy stop-and-go traffic. For example, Bali Express, a cross-border Class 8 operator, has electrified 10% of its fleet. Benefits include:

- Reduced energy use during long border crossing delays

- Improved driver comfort and reduced fatigue

- Lower exposure to diesel exhaust in high-traffic shipping areas

One independent operator talked about the drayage sector as another place where electrification is beneficial and not as cost prohibitive. The ability to charge vehicles at either the unloading or loading station allows drivers to reduce wait time at chargers where they would otherwise be losing time, and therefore money. There were also discussions on how to incentivize drayage trucks beyond reducing the initial cost of the EV. For example, EVs could be exempt from port fees that are designed to offset particulate emissions. Ports could also implement an express lane that is only accessible to zero-emission trucks, which would increase their productivity.

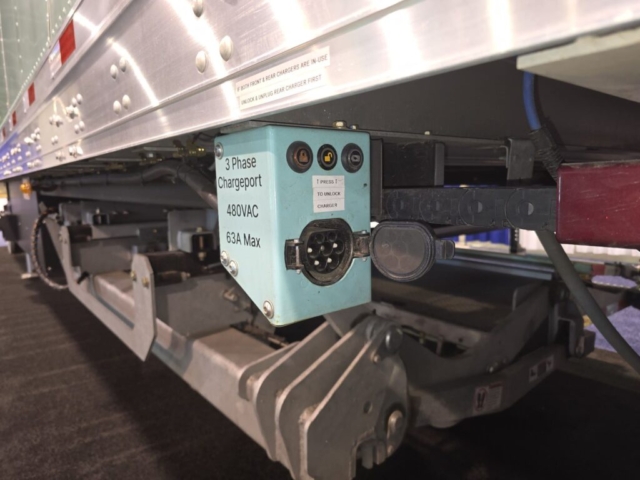

COLD CHAIN TRANSPORTATION IS GETTING ELECTRIFIED

When transporting temperature-controlled freight in refrigerated trucks (“reefers”), operators must account for the increased energy consumption (and often emissions) associated with powering the on-board refrigeration systems. The major OEMs in this sector already offer hybrid refrigeration equipment that runs on electricity when plugged into “shore power.” Several exhibitors demonstrated reefer units and supporting infrastructure compatible with the 3-phase 480VAC connector standardized by the Society of Automotive Engineers (SAE J3068) and the American Trucking Association (RP-185). Additional development of this standard could support the deployment of fully electric reefers by allowing trucks to charge their batteries as quickly as possible while also powering their refrigeration equipment with shore power.

ADDITIONAL HIGHLIGHTS FROM SESSIONS AND THE EXHIBIT FLOOR

- Video: Exhibitors demonstrate that EV supply equipment can support both J3400 and J1772 vehicles without adapters.

- Trenchless charging installation methods provide a viable option for fleets leasing parking spaces:

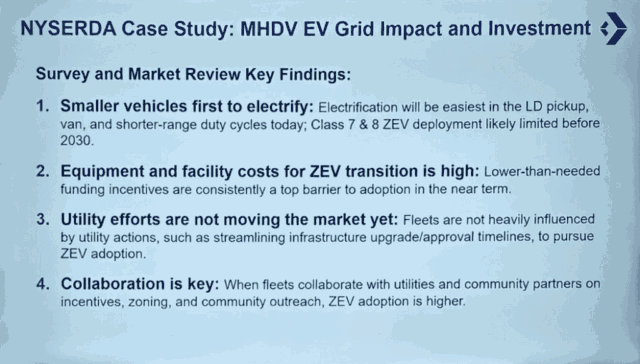

- NYSERDA shared early results from its medium- and heavy-duty EV deployment program:

- Electrified fleet vehicles come in many shapes and sizes:

LEARN MORE

Interested in fleet electrification or EV charging strategy? 2050 Partners supports utilities, government agencies, national laboratories, and research organizations navigating this transition. Contact us today to learn more or schedule a conversation.

We look forward to seeing you at the ACT Expo in 2026!